Masaki Ogata: Open Innovation and MaaS of JR East

12th Ludwig Boltzmann Forum, 20 February 2020

Summary by Gerhard Fasol

Masaki Ogata

- East Japan Railway Company, Board Director and Vice-Chairman, Executive Vice President of Technology & Overseas Related Affairs

- Honorary President, UITP (International Association of Public Transport)

- Member of Council for Science and Technology, Chairperson of Subdivision on Professional Engineers, Ministry of Education, Culture, Sports, Science and Technology Japan

- Chairman & CEO, Japan Institute of IT

- Chairman Tohoku Tourism Promotion Organization

- Director Tohoku Electric Power Company Inc.

Summary: Open Innovation and MaaS of JR East

With 17.9 million passengers/day, 12,209 trains/day on a network of 7402 km, JR-East is one of the largest railway companies in the world. JR-East is a fully integrated group including ownership, manufacture and maintenance of rolling stock, infrastructure including track, stations and real-estate, trains and buses, and life-style business, and one of the first and most advanced fin-tech systems globally: electronic payment systems and electronic money.

JR-East receives no government subsidies, and had no fare or charge increases for 33 years (except for increases in the consumption tax).

JR-East is constantly innovating, developing MaaS, deepening fin-tech and mobile payments, and increasing Shinkansen speeds to 360 km/h.

Mr Ogata sees the MaaS revolution as a revolutionary economic wave occurring once in 100 years, and works for JR-East to drive this Maas wave.

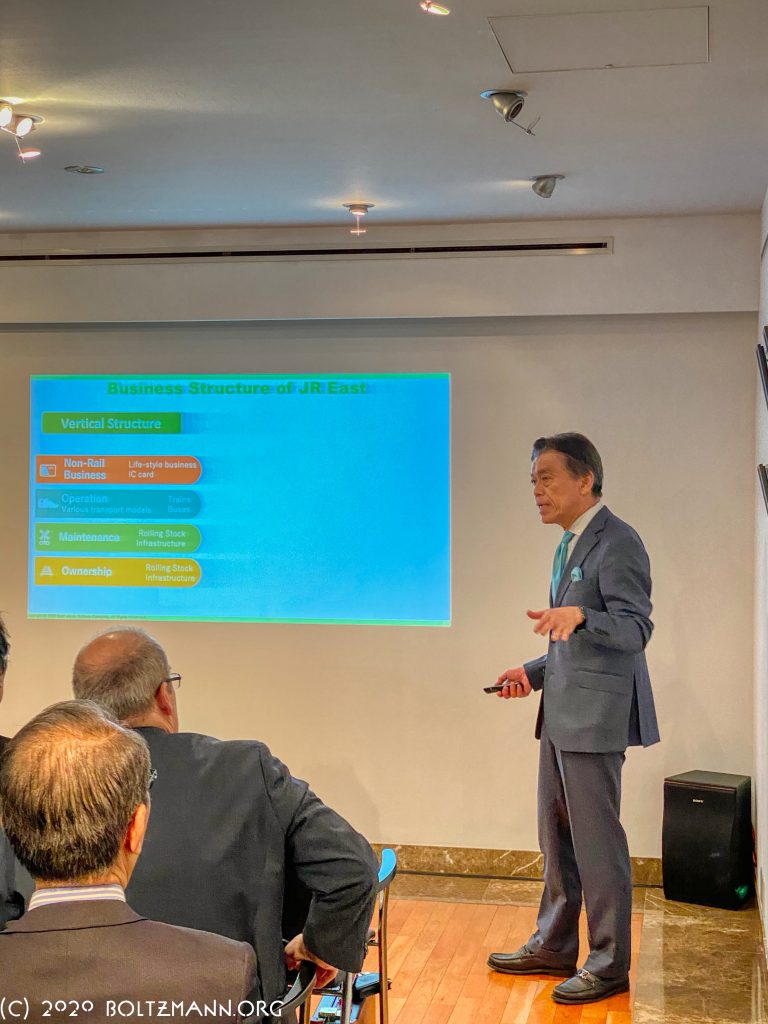

7 Features of JR East Management

Vertical structure

- (1) non-rail business: life-style business, IC card

- (2) operation: trains and busses

- (3) maintenance: rolling stock and infrastructure

- (4) ownership: rolling stock and infrastructure

Horizontal structure

Passengers: 17.9 million/day – largest number of passengers globally

Network: 7402 km

Trains: 12,209 trains/day

- (5) Shinkansen

- (6) Tokyo region

- (7) regional lines in North-Eastern Japan

Business Structure

17.9 million customers / day (largest in the world)

FY2018 Revenues: € 24.6 billion

- Transportation business: € 16.7 billion (68%)

- Tokyo metropolitan 58%

- Shinkansen 29%

- Regional 3%

- other transportation (bus, monorail etc) 9%

- Life service business: €7.9 billion (32%)

Safety is always the top priority of JR East management

Multiple business models

a mobility company, covering 24 hours and all the life of people. Synergetic growth with railways as the base and towards Mobility as a Service (MaaS)

- Railway

- Life style (shops, buildings…)

- Micropayment

- Rolling stock manufacture

- Overseas business

Public Transport (PT) in Japan and in the world

- railway companies – Japan: 200, globally: 3000

- bus companies – Japan: 7000, globally: 80,000

- taxi companies – Japan: 16,000, globally: 200,000

- (taxi cars in Japan: approx. 260,000)

Public Transport (PT) leads Mobility as a Service (MaaS)

- PT innovation

- improvement by intermodal cooperation (e.g. JR-East through trains to other railways companies and Tokyo subways)

- integration with new mobility solutions

STTT Model (Shortening Total Trip Time = STTT)

Customers are mainly interested in the total trip time. Shorten total trip time by reducing the time of each component of the trip, and in particular access to public transport at both ends (e.g. by bicycle, moped or “new personal mobility” e.g. shared electro-scooters etc), and shorten transitions between different means of transport.

Maximum transport capacity per direction per hour:

- automobile: 1000

- bus: 2500

- LRT: 11,000

- monorail: 21,000

- mini-metro: 35,000

- heavy rail, incl. metro: 64,000

- heavy rail (e.g. JR East Chuo Line): 100,000

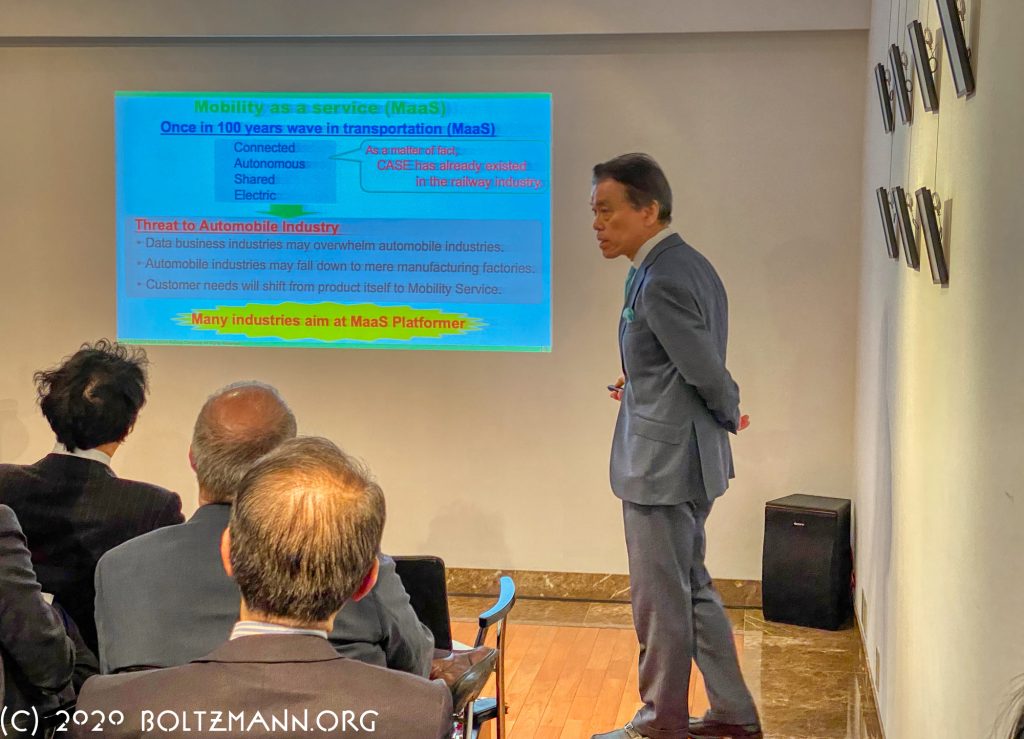

Mobility as a Service (MaaS): a once-in-a-century wave of change including the public transport (PT) industry

We see the development of Mobility as a Service (MaaS) as a massive once-in-a-century change of paradigm which includes the public transport (PT) industry

We see an evolution from privately owned, manually operated automobiles to sharing, on-demand, autonomous operation integrated with public transport. Current public transport + new concepts such as UBER, Lyft, in Japan “Times Car Plus” integrating with innovations in public transport.

Once in 100 years wave of change in transportation (MaaS) is a threat to the automobile industry

the new paradigm CASE was always the case for the railway industry:

- Connected

- Autonomous

- Shared

- Electric

Many industries aim at becoming the dominating MaaS platform

We see a big threat to the automobile industry from several directions:

- data businesses may overwhelm automobile companies

- automobile companies may decline into commodity manufacturing

- customer needs (and value to the customer) will shift from the product (car) itself to mobility service

Mobility wave as economic cycle

- Kitchin cycles (inventory): 3.3 years (3-5 years, e.g. pork cycle)

- Juglar cycles (investment): 10 years (7-11 years, see e.g. Korotayev, Andrey V; Tsirel, Sergey V., “A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis”)

- Kuznetsk cycles (demand of buildings, infrastructure investments): 20 years

- Kondratieff cycles (innovation): 50 years (naming suggested by Joseph Schumpeter)

- “Mobility wave”: 100 years

Open Innovation of JR East

(1) innovation of operations

- Speed-up of Shinkansen

- 1987 operation speed = 240 km/h

- 2019 operation speed = 320 km/h

- 2019 test speed = 400 km/h

- aiming at operation speed of 360 km/h

- Number of trains

- 1987: 11,175 trains/day

- 2019: 12,209 trains/day (+ 9.3%)

- Enhancement of sustainability

- average CO2 emission per railway passenger

- 1/7 of automobiles

- 1/5 of airplanes

- JR East: 1/2 of global rail average

- average CO2 emission per railway passenger

- Enhanced efficiency of train operations

- 1987: 71,000 staff in JR East’s Railway Operation Division

- 2019: 39,000 staff

(2) IT innovation

- Number of IT systems

- 1987: 3 IT systems

- 2019: 1224 IT systems

- Big Data and Condition Based Maintenance (CBM)

- CBM is now being introduced for track, rolling stock, electric facilities…

- IT for customer service: “JR East App”

- Japanese version: 4.8 downloads

- Multi-lingual version (English/Chinese/Korean): 500,000 downloads (as of January 2020)

No government subsidies and no fare/charge increases for 33 years

For the past 33 years (since 1987):

- no subsidies from central or local governments

- no increased fares or charges (except for consumption tax increases)

Examples of innovation: SUICA and fintech since November 2001

Evolution from analog paper tickets to fintech

- paper tickets (analog)

- magnetic ticketing cards stage 1: NRZ1 (non-return-to-zero) (these tickets have a brown backside)

- magnetic ticketing cards stage 2: FM (F2F) (Frequency modulation) (these tickets have a black backside)

- magnetic cards for stored fares (SF)

- SUICA IC Chip memory since 18 November 2001

- Authentication, micropayments > fintech from March 2004

- Mobile SUICA integration with mobile phones, start: January 2006

- development of new business

SUICA started on 18 November 2001: an example of open innovation

SUICA: cooperation between JR East and SONY

- transactions in 200 milli-seconds

- ticketing

- commuter passes

- micropayments

- mobile SUICA

Open strategy

- technical disclosure to industry peers: disclosure to more than 200 railway companies in Japan

- standardization of the technology – de-facto standards:

- better customer service

- big impact on society and the nation

- scale merit: scaling!

- 23 March 2013: completion of nationwide platform

- complete mutual usage

- coverage: 12% of the population

- 5000 railroad stations

- 50,000 buses

Development of SUICA

- 18 Nov 2001: implemented IC ticketing SUICA in Tokyo

- 22 March 2004: launched micropayment service (e-money) based on SUICA IC card ticketing system

- 28 January 2006: launched “mobile SUICA” for feature phones

- 18 March 2007: interoperable service with PASMO

- 23 July 2011: launch of Mobile SUICA services for smart phones

- 23 March 2013: launched interoperable service with 10 regional transport cards for 142 operations, later expanded to currently 258 operating companies

- interoperable transport IC card systems: total 160 million cards

- mobile SUICA: 9.0 million members

- micropayments:

- maximum transactions/day: 9.58 million

- transactions per month: 253 million

- member stores: 850,000 (as of December 2019)

Micropayment fintech in Japan is driven by SUICA and railroad payment cards:

3 tsu (通)

- Tsushin (通信) = communications

- Kotsu (交通)= transport

- Ryotsu (流通) = logistics

It took almost 20 years to move from the initial introduction of IC card based SUICA micropayments for transport on 18 November 2001 to the cashless society policy movement in Japan from 2018.

MaaS of JR East

The MaaS platform of JR East aims to include a wide range of business areas:

- single mode type: automated driving and car sharing

- integrated type of multi PT modes: bus, railways, Shinkansen

- integrated type of mobility: bike sharing, rent-a-car, taxi

- MaaS of JR East platform further includes: restaurants, shopping, hotels, tourism, inns, kiosks, luggage lockers etc

- telecommunication carriers

- local government and other services

MaaS aims for all integrated services = all mobility + any added values with lean start-up and agile development philosophies

Proof of concept for JRE MaaS

- Niigata, Shonai area: Niigata MaaS Trial since October 2019

- Tohoku area: under consideration, PoC from 2012

- Sendai area: PoC since February 2020

- Tokyo Metropolitan area: PoC since August 2018, public release from January 2020

- Izu (Shizuoka Prefecture), PoC in cooperation with local operator Izukyu Corporation.

- Phase 1: April 2019 – June 2019

- Phase 2: December 2019 – March 2020

Future customer journey will provide “24 hours, one-stop” services from wake-up, digital time management to transportation with flexible schedule change, meeting management, and one-stop reservations for transport, restaurants, hotels etc including easy and automatic check-in

“3D smooth trip”

- horizontal: through operations

- vertical: barrier free equipment

- psychological: smart card in stations and trains with 0.2 second transactions

4 service levels – MaaS app under PoC

- Level 1: integration of information: information app and route search engine

- Level 2: integration of booking and payment, SUICA micropayments

- Level 3: integration of service offer, bundling, subscriptions, contract, commuter pass and through operations

- Level 4: integration of national policy, government

Moving Further Forward

MTOMI model = Management + Technology + Operation + Maintenance + Infrastructure

Integrating technology and service industry provides value and service to customers, community, society and the nation.

The moment of truth is hospitality.

The Triangle:

- customers and the moment of truth: hospitality

- management policy

- MTOMI model + well-disciplined employees

Genuine infrastructure = MTOMI Model optimizes multiple resources and services and offers multiple options to consumers

Integration of the MTOMI Model + sophisticated service provides value to customers, communities, societies, nation and the world > MaaS of JR East

Public Transport (PT) will lead MaaS

In the ICT field GAFA (Google, Apple, Facebook, Amazon) and other Silicon Valley and Chinese companies are far ahead, however Japan has unique infrastructure, especially railway infrastructure as unique fields of application for ICT.

Just Shinjuku station alone is a unique application field.

Scale and speed are the keys to success.

ICT and Public Transport (PT) are an excellent match for each other.

Ultimate mobility means: everyone can move freely at anytime to anywhere with comfort by mobility of high quality

contact

Copyright (c) 2020 Eurotechnology Japan KK All Rights Reserved

Leave a Reply